Corporations are harming Europe’s competitiveness by choosing to hoard a greater share of profits instead of reinvesting them to raise productivity and create quality jobs, an analysis of EU data by the European Trade Union Confederation (ETUC) shows.

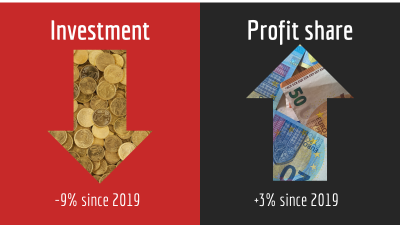

Gross investment has fallen by 9% across the EU since 2019 and is at its lowest rates since 2014, when the economy was still reeling from the financial crisis.

By contrast, profit share has risen by 3% since 2019. That has coincided with a huge increase in dividends, meaning profits have been siphoned out of companies and into the pockets of wealthy shareholders.

| Change in profit share | Change in gross investment | |

| Croatia | +11 | -12 |

| Netherlands | +10 | -6 |

| Ireland | +7 | - 68 |

| Luxembourg | +7 | -22 |

| Poland | +7 | -23 |

| Belgium | +6 | -3 |

| Denmark | +6 | -2 |

| Germany | +6 | -4 |

| Slovakia | +6 | -8 |

| Italy | +5 | -4 |

| Estonia | +4 | -1 |

| Austria | +3 | -5 |

| EU | +3 | -9 |

| Eurozone | +3 | -10 |

Source:NASA_10_KI https://ec.europa.eu/eurostat/databrowser/view/NASA_10_KI__custom_13133437/default/table?lang=en

Our analysis comes after the Draghi report said the EU needs to raise investment by €800 billion a year to achieve higher productivity and economic growth.

The figures show how corporate greed is playing an important part in Europe’s investment deficit and the growing crisis in European industry which is costing thousands of quality jobs.

The ETUC is calling on the European Commission to solve the problem by using the upcoming revision of public procurement to make contracts dependent on a commitment to reinvest more money into raising productivity and creating quality jobs.

Commenting on the findings, ETUC General Secretary Esther Lynch said:

“Everyone agrees that we urgently need to raise productivity to remain competitive and yet we see some CEOs treating businesses like a get-rich-quick scheme rather than investing in the future.

“EU data clearly shows that part of the solution to raising productivity and staying competitive is creating a more responsible corporate culture in Europe.

“European companies should be reinvesting more of their profits to raise productivity and create quality jobs, not wasting it on bigger CEO bonuses or siphoning it off in more dividends for rich shareholders.

“Making public contracts dependent on reinvesting a fair share of profits would be an effective way of changing the unethical business behaviour which is holding back badly needed investment.”

Notes

Note: Table 1 refers to relative change in the percentage gross profit share of non-financial corporations (B2G_B3G/B1Q*100), and gross investment rate of non-financial corporations (P51/B1G*100).